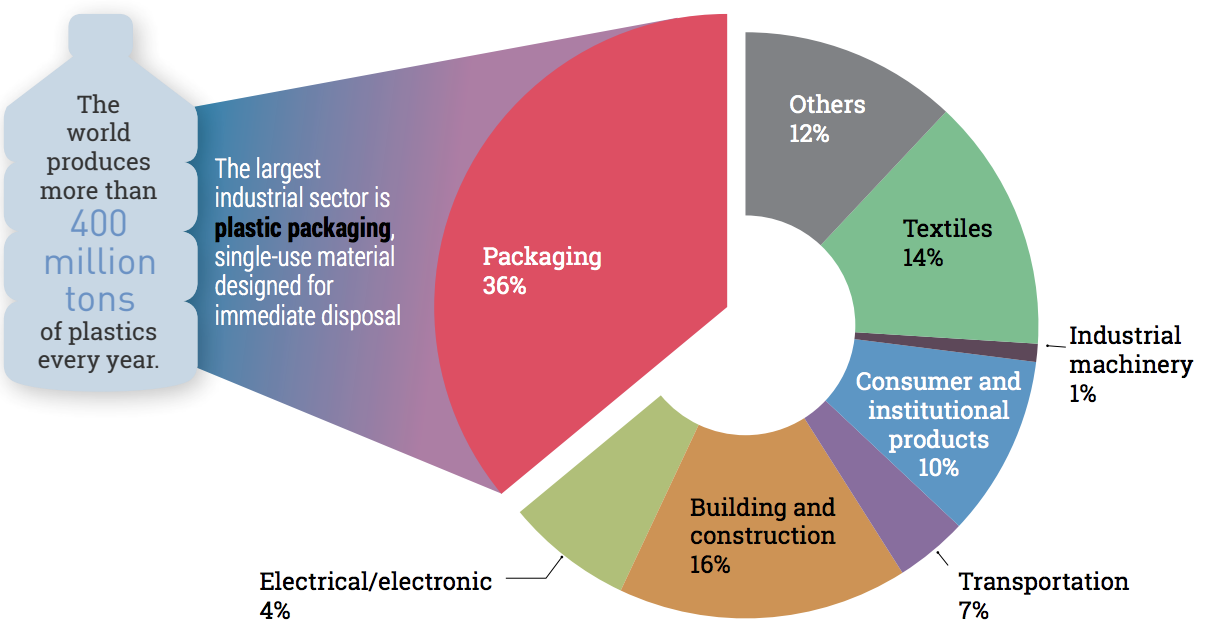

Against the backdrop of the global wave of “plastic limitation and ban” policies, such as the EU Single-Use Plastics Directive and China’s “Plastic Reduction 2.0,” the injection molding industry is undergoing profound transformation. While facing challenges like regulatory pressures and high costs of adopting sustainable materials and advanced technologies, the industry is expected to achieve a 4.8% CAGR from 2025 – 2032, driven by demand for automotive lightweight components, biodegradable packaging, and smart manufacturing. This report analyzes market trends, technological innovations, and regional dynamics, offering actionable insights for stakeholders to thrive in the evolving, sustainability – focused landscape. To directly provide you with data and insights, this article will be concise in its writing and will not include excessive descriptions.

I. Executive Summary

- The global “plastic limitation and ban” policies have accelerated the injection molding industry’s transition toward sustainability and technological innovation.

- Despite regulatory pressures, the industry is projected to grow at a 4.8% CAGR from 2025–2032, driven by biodegradable materials, smart manufacturing, and emerging market demands.

II. Market Dynamics Under Policy Pressures

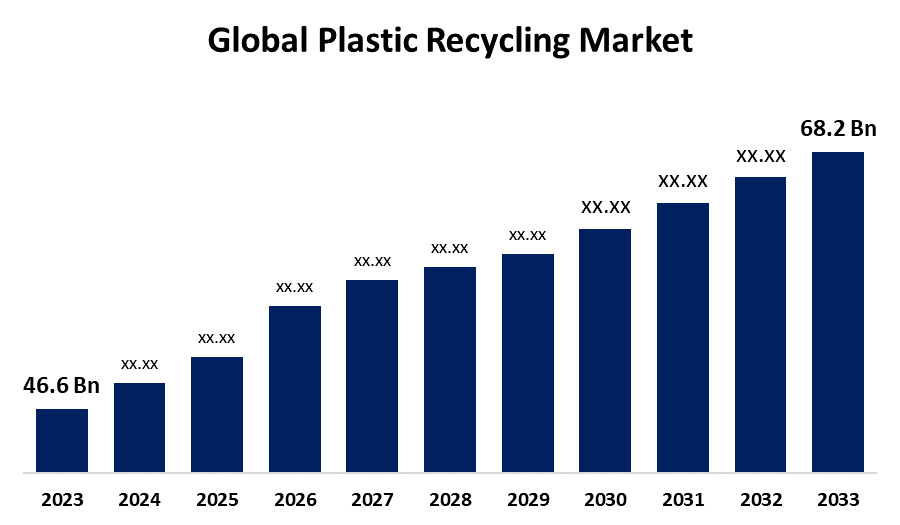

Global market data reflects both the challenges and opportunities of this transition. The industry valued at 287.5billion in 2023 is projected to reach 438.5 billion by 2032, with regional variations highlighting distinct growth profiles:

Asia-Pacific is dominating 32.9% of global injection molding machine sales in 2023, and China leads the charge, driven by its automotive and electronics sectors. More and more countries are replacing foreign manufacturing with localized production, and these trends have elevated local high-end market share from 15% to 28% since 2020, meaning less reliance on foreign technologies. As China’s neighbor, India, meanwhile, is emerging as a growth hotspot with a 7.2% CAGR, fueled by rising consumer goods and medical device demand.

Europe: While grappling with a 16% year-on-year decline in machine orders in 2024 due to energy costs and Asian competition, the region remains a green technology leader. Its PLA market, valued at $42.9 billion in 2023, is forecast to expand at a 16.3% CAGR, driven by strict circular economy mandates.

Key growth engines include automotive lightweighting—where EV manufacturers like Hyundai’s Georgia plant (300,000 annual capacity) rely on plastic components to reduce vehicle weight—and packaging transformation, with biodegradable food containers and thin-walled designs accounting for 30% of global applications.

In short, refer to this table:

| Region | 2023 Market Value | 2032 Forecast (CAGR) | Data Source |

| Global | $287.5B | $438.5B (4.8%) | SkyQuestt. (2024). Injection Molding Market Size & Forecast. |

| China | $53.7B (plastics) | $82.8B (5.7%) | National Bureau of Statistics of China (NBS) |

| Europe | $42.9B (PLA) | $422B (16.3%) | Fortune Business Insights. (2024). Polylactic Acid Market Forecast. |

III. Technological & Material Innovations

3.1 Biodegradables Scaling Industrial Adoption

Eco-polymers aren’t niche anymore—they’re becoming production staples. Look at NatureWorks’ new Thailand PLA plant: its 150,000-ton capacity (operational Q3 2024) signals how producers are betting big on compostables. We’re seeing real traction:

- PLA output jumped from 342K tons (2022) to projected 950K+ tons by 2030 (Corbion PURO® driving food-grade adoption)

- Closed-loop wins: Arburg’s Gestica controls now slash virgin plastic use 30% in PepsiCo’s Frito-Lay bag lines – no more trial runs, just production-proven savings

Engineer’s note: Watch crystallization rates on PLA – under 170°C barrel temps prevent jamming (BASF processing guide 2023).

3.2 Industry 4.0 Hits the Shop Floor

Forget theoretical “digital transformation”—today’s smart factories deliver hard ROI. Hehnke GmbH’s automated packaging cells prove it:

- 25% labor cost reduction after deploying Yaskawa robots for insert molding

- 40% fewer rejects since implementing real-time cavity pressure monitoring

The game-changer? Digital twins that simulate mold flow before steel cutting. One medtech supplier cut energy bills 15% by optimizing cooling channels virtually – crucial when running PEEK at 380°C. These aren’t lab experiments; they’re why contract molders like Jabil dominate precision medical device bids now.

IV. Regional Market Analysis

4.1 Asia-Pacific: Still Leading the Pack

- Chinese Market: China accounted for 32.9% of global injection molding machine sales in 2023, driven by automotive and electronics sectors . The domestic substitution trend has raised local high-end market share from 15% to 28% (since 2020).

- The Potential of India: India’s injection molding market is growing at 7.2% CAGR, fueled by rising demand for consumer goods and medical devices.

4.2 Europe: Navigating Headwinds with Strategy

- Order Decline: European injection machine orders fell 16% YoY in 2024 due to high energy costs and competition from Chinese/Japanese manufacturers.

- Green Transformation: EU’s circular economy initiatives have boosted demand for bio-based materials, with Germany’s medical device sector adopting PLA for 40% of implants.

V. Challenges & Strategic Outlook

5.1 Cost Pressures

- Material Cost: Biodegradable plastics cost 20–30% more than traditional polymers, squeezing profit margins for SMEs.

- Equipment Update: High-end machines (e.g., metal injection molding systems) require $1M+ investment, limiting adoption in emerging markets.

5.2 Competitive Strategies

To stay ahead, larger players have been doubling down on strategic mergers and acquisitions. A good example is Krones, which recently poured around $170 million into acquiring Netstal, signaling a push into both the medical device sector and high-speed thin-wall packaging.

Meanwhile, in Europe, a different trend is taking shape. Some manufacturers—take Weimeng Group, for instance—have been shifting parts of their production lines to lower-cost countries like Turkey and Hungary. By doing so, they’ve managed to slash energy costs by up to 40%, which, given current utility prices in Western Europe, makes a lot of economic sense.

VI. Conclusion

The injection molding industry is undergoing a transformative shift under plastic restriction policies, with sustainability and automation emerging as key differentiators. While challenges like material costs and regulatory complexity persist, opportunities in EV manufacturing, medical devices, and circular economy solutions offer significant growth potential. Industry players must prioritize R&D in biodegradable materials and smart technologies to thrive in this evolving landscape. For more insights and trend reports, please visit our blog page.

References

- SkyQuestt. (2024). Injection Molding Market Size & Forecast.

- Research and Markets. (2024). Plastics Injection Molding Market Outlook.

- Grand View Research. (2024). Injection Molding Market Analysis.

- Gelonghui. (2024). 2024 Research Report on Injection Molding Plastics Industry.

- Fortune Business Insights. (2024). Polylactic Acid Market Forecast.

- VDMA. (2024). European Plastics Machinery Report.

- Nova-Institute. (2023). Bioplastics Production Data.

- Sohu (2024). Development Report on China’s Injection Molding Products Industry.

Note: Last updated on 6/6/2025